Oil and gas market analyst Rystad Energy is expecting a rise in 2019 of final investment decisions (FID’s) on new petroleum projects (excluding shale and tight oil and gas prospects) worldwide. This could result in 46 billion boe sanctioned volumes which equals to three times the amount of sanctioned volumes in 2018.

These predictions should be considered cautiously because – as Rystad points out themselves- FID’s got off to a good start in the first half of 2018 as well but several project delays during the fourth quarter, combined with a steep drop in oil prices, prevented growth in sanctioned volumes. This year the same could happen. “Delays to a few megaprojects currently expected to be approved in the second half of 2019 could turn the volume down significantly,” cautions Rystad Energy upstream research analyst Readul Islam.

Back to the forecast, Rystad expects substantial growth for deepwater, offshore shelf and other conventional onshore developments. The only supply segment likely to shrink this year is the oil sands.

No growth in Europe and North America

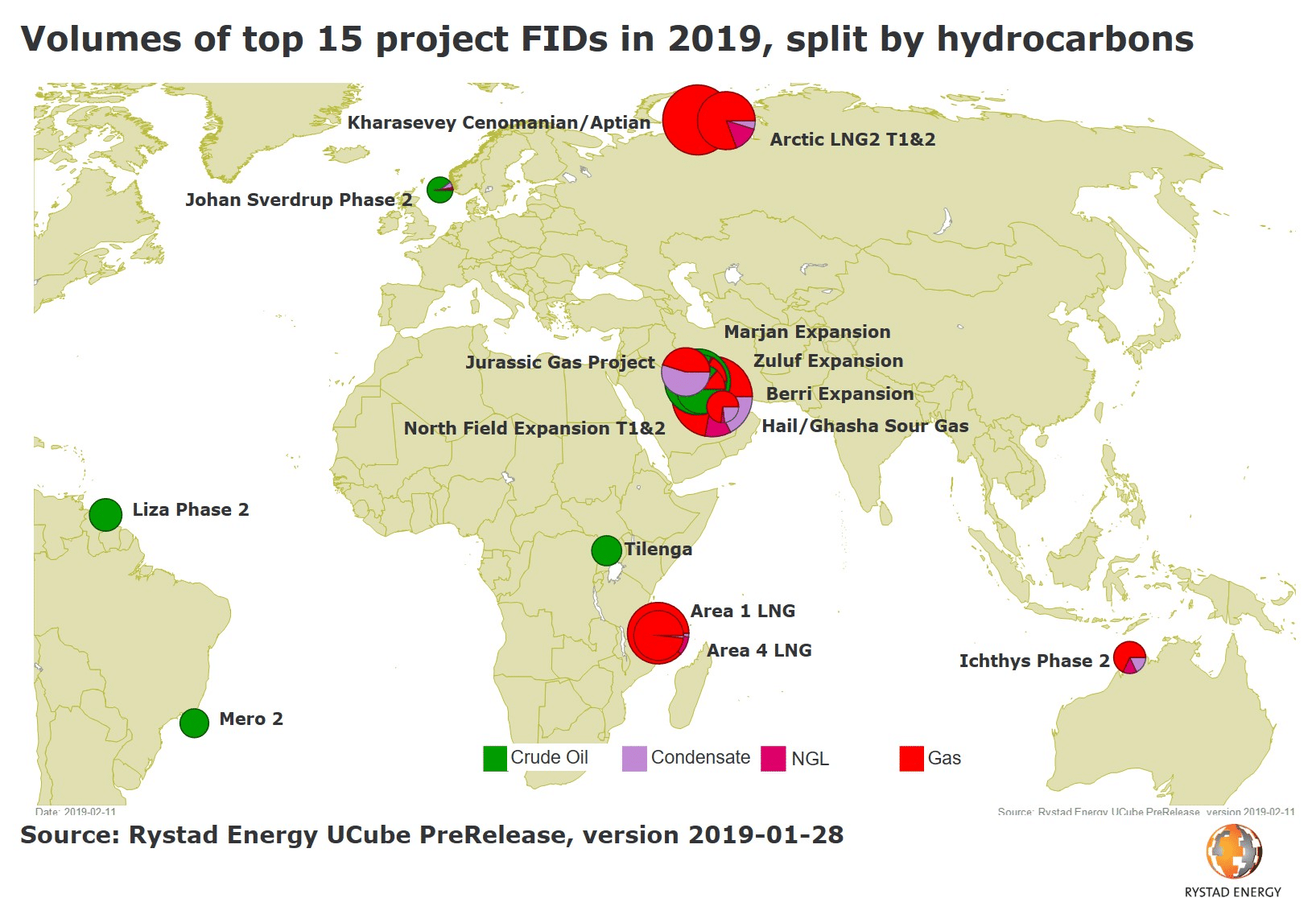

From a geographical perspective, it is remarkable that Europe and North America are not taking part in the growth, but all other regions are headed for robust growth. In Northwest Europe only Johan Sverdrup phase 2 project makes it into the top 15 project FID’s.

Three drivers

Rystad Energy research states that three main factors are driving this growth:

The rising demand for cleaner fuels and the threat of an LNG undersupply developing by the mid-2020s is likely to spur sanctions for natural gas projects in Africa, Australia, the Middle East and Russia. LNG projects make up a third of the estimated FID volumes this year.

Following the 2014 price crash, projects had to be commercially viable at lower prices, resulting in project delays. Now these delayed projects are starting to get sanctioned and they can make up almost a quarter of the FID volumes in 2019.

Saudi Arabia appears likely to greenlight three major offshore shelf expansion projects that would collectively account for nearly a fifth of global FID volumes this year.

Read here the Rystad Energy press release.